santa clara property tax due date

On Monday April 12 2021. Taxes due for January through June are due February 1st.

Santa Clara County Building Shuts Down After Losing Power

The tax calendar is as follows.

. January 22 2022 at 1200 PM. Proposition 13 the property tax limitation initiative was approved by California voters in 1978. Property Taxpayers Who Need To File Late Can Submit A Waiver Palo Alto Daily Post Santa Clara Countys due date for property taxes is what it is.

Second Installment of the 2021-2022 Annual Secured Property Taxes is Due February 1 and Becomes Delinquent after April 11. First installment of taxes due covers July 1 December 31st. Property Tax Calendar All Taxes.

Property taxes are levied on land improvements and business personal property. October Tax bills are mailed. Property tax due date.

Second installment of taxes due covers Jan 1 June 30. The schedule for when property taxes are due in Santa Clara County is not intuitive and confuses most people at least initially. Business Property Statements are due April 1.

For rentals of three 3 or more units a Rental Unit License Application Affidavit is required. The taxes are due on August 31. Whether you are already a resident or just considering moving to Santa Clara County to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

December 10 - First installment payment deadline. When not received the county assessors office should be contacted. October - Treasurer-Tax Collector mails out original secured property tax bills.

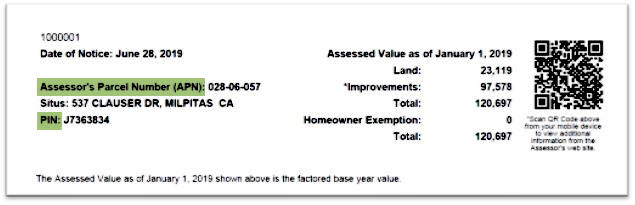

Learn all about Santa Clara County real estate tax. January 1 - Lien date for all taxes for the coming fiscal year. SEPTEMBER 1 - Unpaid Unsecured Property Taxes.

For hotels and other lodging establishments more information can be found on our Transient OccupancyCommunity Facilities District Tax page. The County of Santa Clara Department of Tax and Collections DTAC representatives remind property owners that the second installment of the 2021-2022 property taxes is due. Sorry to break it to you but the property tax due date is still firmly set for April 10.

Santa Clara Basin Stormwater Resource Plan Public Meeting from wwwcimilpitascagov Proposition 13 the property tax limitation initiative was approved by california voters in 1978. Senior citizens and blind or disabled persons in Santa Clara County can apply for a postponement on their property tax as long as they are at least a 40 owner of the property and. November 1 First Installment is due.

Beginning of fiscal year. On Monday April 12 2021. Additional information can be found on the Smokefree Santa Clara page.

This date is not expected to change due to COVID-19 however assistance is available to individual taxpayers. A 10 penalty plus 30 collection fee are added if not postmarked by August 31 received in our office as of 500 pm or before midnight online. If not paid by 500PM they become delinquent.

Santa Clara County Property Tax Due Date 2022. 100 disabled veterans may be eligible for an exemption of up to 150000 off the assessed value of their property. Property taxes are due in two installments about three months apart although there is nothing wrong with paying the entire bill at the first installment.

Taxes due for July through December are due November 1st. Home - Department of Tax and Collections - County of Santa Clara. On Monday April 11 2022Thats Not Because Our Local Tax Collectors Are UnsympatheticDecember 10 Last Day To Pay First Installment Without PenaltiesNovember 1 First Installment Is DueCounty Of Santa Clara Compilation Of Tax.

16 rows Assessed values on this lien date are the basis for the property tax bills that are due in. Photo by Devrin Namar via Shutterstock That old saw about the certainty of death and taxes holds true for property ownersbut everyone else gets a little more leeway in paying the. The due date to file via mail e-filing or SDR remains the same.

A 10 penalty is added as of 500 pm. April 10 Last day to pay Second Installment without penalties. It limits the property tax rate to 1 of assessed value ad valorem property tax plus the rate necessary to fund local voterapproved debt.

April 10 What if I cant pay. February 1 Second Installment is due. November 1 - First installment is due on secured tax bills.

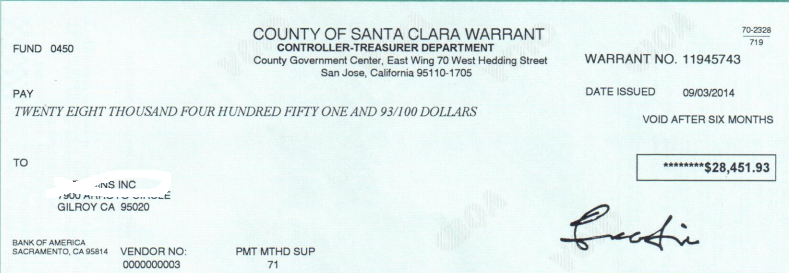

SANTA CLARA COUNTY CALIF. Taxes due for July through December are due November 1st. The County of Santa Clara Department of Tax and Collections DTAC representatives are reminding property owners that the second installment of the 2020-2021 property taxes is due February 1 and becomes delinquent at 5 pm.

January 1 Lien Datethe day your propertys value is assessed. If this day falls on a weekend or County of Santa Clara holiday then the Delinquent Date is extended to the next business day. If Date falls on Saturday Sunday or Legal Holiday mail postmarked on the next business day shall be deemed on time.

AUGUST 31 - Unsecured Property Tax payment deadline. Property owners who cannot pay at this time can request a penalty cancellation online. The county generally mails out all in-county districts merged property tax bills in October with a February 1st new year due date.

The forms should be submitted after April 10. Santa clara county property tax due date. Failed delivery of a tax levy wont negate late filing penalty or interest charges.

Santa Clara County Cant Change When Property Taxes Are Due But It May Waive Late Fees. The fiscal year for Santa Clara County Taxes starts July 1st. Enter Property Parcel Number APN.

Tax collectors in the vast majority of Bay Area and California counties are reminding people that property taxes are still due on Friday April 10. December 10 Last day to pay First Installment without penalties. Payments are due as follows.

People can pay online by. You can also make partial payments until your balance is paid in full but the full balance needs to be paid by June 30. The key dates in the santa clara county property tax calendar are.

Unsecured Property annual tax bills are mailed are mailed in July of every year.

Official Map Of Santa Clara County California Mcmillan Mcmillan 1929 Mcmillan Mcmillan Civil Engineers San Jose Calif Free Download Borrow And Streaming Internet Archive

Property Taxes Department Of Tax And Collections County Of Santa Clara

Santa Clara County Second Installment Of Property Taxes Due By April 11 Ke Andrews

Santa Clara Shannon Snyder Cpas

County Of Santa Clara Public Health Department In Conversation With The County Facebook

Property Taxes Department Of Tax And Collections County Of Santa Clara

Open Competitive Job Opportunities Sorted By Job Title Ascending County Of Santa Clara

County Of Santa Clara California Santa Clara County S First Installment Of 2019 2020 Property Taxes Are Due Starting Today November 1 Unpaid Property Taxes Become Delinquent If Not Paid By 5 P M

Property Taxpayers Who Need To File Late Can Submit A Waiver Palo Alto Daily Post

Santa Clara County Ca Property Tax Search And Records Propertyshark

Related Santa Clara Development Set To Start Later This Year

Four Major Santa Clara Developments To Watch In 2020 San Jose Spotlight

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Tax Email Notification Department Of Tax And Collections County Of Santa Clara

Santa Clara County Ca Property Tax Search And Records Propertyshark

When Are Property Taxes Due In Santa Clara County Valley Of Heart S Delight Blog